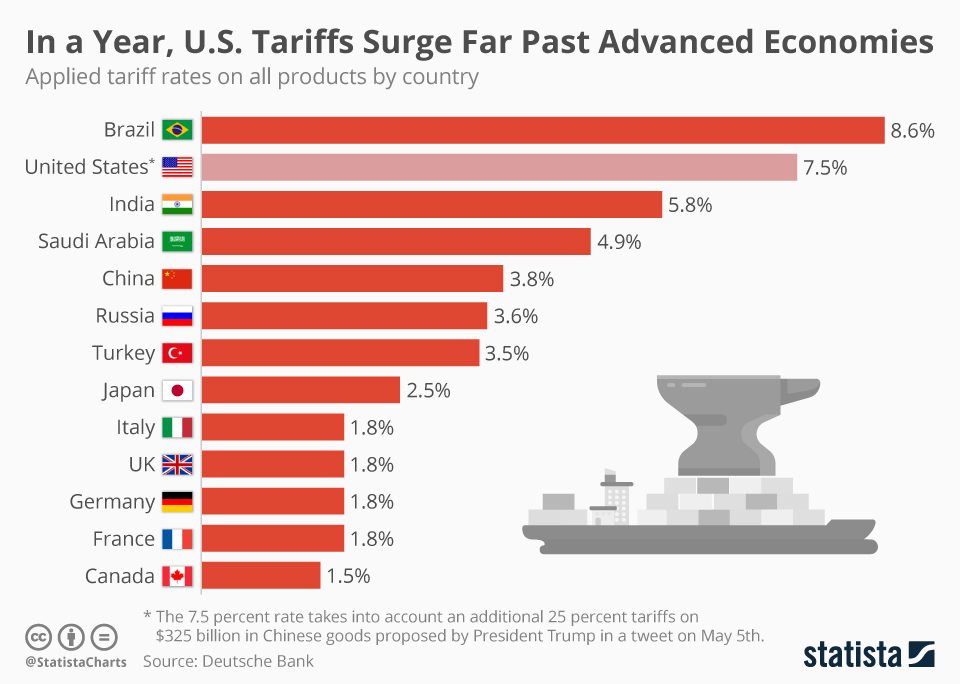

The relationship between tariffs and the U.S. economy is a topic of heated debate among policymakers, economists, and business leaders alike. Tariffs, particularly when imposed strategically, can significantly influence trade policy and reshape the competitive landscape for American workers. Senator Rick Scott has been a vocal advocate for such measures, arguing that U.S. tariffs, particularly against countries like China, can level the playing field and protect domestic industries. As the U.S. grapples with trade relations that are continually evolving, import tariffs, such as those discussed recently, could play a crucial role in determining the economic future of the nation. With his firm belief in the necessity of these tariffs, Scott highlights their potential benefits, even amidst warnings of adverse effects on economic growth and inflation.

At the forefront of discussions surrounding international trade and economic strategies, the impact of trade barriers on the U.S. financial landscape cannot be understated. The imposition of import duties, also known as tariffs, is seen by some, including Senator Rick Scott, as a method to enhance the competitive position of American workers against international rivals. With escalating tensions in China trade relations, the debate over these tariffs brings to light the broader implications for U.S. economic health and global market stability. Advocates of aggressive trade policies argue that adjusting tariff rates may stimulate domestic production, while critics caution against potential backlash and economic downturns. This ongoing dialogue reflects the complexities of formulating effective trade policies in an interconnected global economy.

The Impact of Rick Scott’s Tariffs on U.S. Workers

Rick Scott’s endorsement of the Trump administration’s tariffs has sparked considerable debate about their impact on American workers. By advocating for a strategy that imposes higher tariffs on imports, Scott believes this will enhance the competitiveness of U.S. meat and dairy products in international markets. He argues that these tariffs will help American workers sell more products abroad, as other countries would be pressured to reduce their barriers against American goods. This perspective focuses on creating an equitable market environment, where U.S. products can compete fairly without the hindrance of foreign tariffs.

However, the broader economic implications of these tariffs are complex. While they may protect certain industries in the short term, many economists argue that they could lead to increased prices for consumers and potential job losses in sectors that rely on imports. For instance, industries that depend on low-cost materials from abroad may face rising costs, which could subsequently affect their ability to hire or maintain current employment levels. Ultimately, the long-term effects of Scott’s tariff approach on American workers remain uncertain.

U.S. Tariffs and Their Role in Trade Policy

The implementation of U.S. tariffs marks a significant shift in American trade policy, aimed at reshaping how the country engages with its global partners. Rick Scott’s support for these measures underscores a broader Republican strategy to foster a competitive environment that prioritizes American manufacturing. The tariffs imposed on key partners, particularly China, are designed not only to protect local businesses but also to signal America’s intent to push back against perceived unfair trade practices. By advocating for such tariffs, Scott envisions a landscape where U.S. products can thrive without facing undue competition from subsidized foreign industries.

Critics, however, argue that the unilateral imposition of tariffs could lead to trade wars, ultimately harming the U.S. economy. The reciprocal tariffs enacted by countries in response, particularly by China, could escalate tensions and lead to decreased trade volumes. This could result in increased costs for American businesses and consumers alike, contributing to inflation and reducing consumer purchasing power. Thus, the delicate balance between protecting American industries and fostering healthy international trade relations remains at the forefront of contemporary trade discussions.

China Trade Relations: A Critical Perspective

Rick Scott’s view on U.S.-China trade relations reveals a staunch perspective shaped by concerns about China’s economic dominance and military ambitions. His argument that the U.S. should engage in no trade with China stems from a belief that such interactions could undermine national security. With China’s economic power continuing to grow, Scott asserts that the U.S. must take a more aggressive stance in its trade policy, suggesting that keeping tariffs on Chinese imports is essential to ensuring American interests are protected.

This hardline approach aligns with a broader narrative among some U.S. policymakers that views China not just as a trading partner but as a competitor that poses significant risks. The implementation of high tariffs on Chinese goods reflects this sentiment, as many policymakers believe that limiting trade can act as a deterrent against China’s expanding influence. However, this perspective assumes that a hardened trade strategy will not lead to greater economic disruptions domestically, an assumption that remains contentious among economists.

Economic Volatility and Tariff Consequences

The introduction of wide-ranging tariffs by the U.S. government has resulted in notable volatility in global markets. Market instability can be attributed to investor concerns over the potential economic repercussions of one-sided tariff policies. Rick Scott’s assertion that tariffs will empower American workers clashes with evidence suggesting that these measures could inhibit economic growth. For instance, the sharp contraction in the U.S. GDP following tariff announcements indicates that the immediate economic backdrop is sensitive to such aggressive trade policy changes.

Beyond the stock markets, the uncertainty generated by tariffs can ripple through economic sectors, affecting everything from investment decisions to consumer confidence. Economists fear that a prolonged period of trade tension, especially with a key trading partner like China, could lead to reduced economic activities and slower job growth. In this light, while tariffs might seem to provide short-term protection for certain industries, the long-term consequences may undermine the very goals they aim to achieve.

Balancing National Debt with Trade Policy

As Rick Scott emphasizes the necessity of reducing national debt, the interplay between fiscal policy and trade policy becomes evident. Tariffs are often viewed as a tool for increasing government revenue and potentially alleviating some fiscal pressures. However, the effectiveness of tariffs in this manner is debated. Scott’s call for a balanced budget alongside tariff policies calls into question their sustainability; if tariffs provoke retaliatory measures that harm U.S. exports, the anticipated revenue growth could diminish quickly, further complicating the nation’s fiscal landscape.

Moreover, the national debt poses a significant challenge, as increasing tariffs may lead to economic repercussions that counteract efforts to impose prudent fiscal measures. A high national debt might necessitate heightened tariffs, but if consumer spending is adversely affected by these tariffs, it can lead to reduced economic activity and even lower tax revenues. Thus, striking a balance between necessary fiscal policy reforms and the implementation of tariffs is crucial to maintaining a healthy economy.

Future Prospects: Tariffs and Inflation

One of the pressing concerns surrounding the implementation of tariffs is their potential impact on inflation. Rick Scott’s admission of uncertainty regarding tariffs and their inflationary effects highlights a critical debate among economists. On the one hand, proponents argue that tariffs could inflate consumer prices as companies pass increased costs onto consumers. On the other hand, some suggest that the decrease in competition from foreign goods might provide room for domestic suppliers to dominate, potentially stabilizing prices in the long run.

The complex relationship between tariffs and inflation necessitates careful monitoring as it unfolds. If tariffs lead to significant inflation, the U.S. economy could face additional strain, exacerbating the challenges of already rising prices in the consumer market. Conversely, if tariffs successfully boost domestic production without triggering widespread inflation, it could point to a stabilization of economic dynamics. Policymakers must weigh these considerations significantly when determining the future trajectory of tariff policies.

Negotiating Trade: A Path Forward

The discussion around whether it’s preferable to negotiate trade agreements or implement tariffs has gained traction, particularly in light of recent economic challenges. Rick Scott’s stance suggests a preference for straightforward trade deals that may ultimately promote better relationships among nations, especially those that impose tariffs on U.S. exports. The negotiation of trade terms could potentially lead to a collaborative framework that minimizes the need for tariffs, allowing for smoother trade relations and a more beneficial environment for American workers.

However, the complexity of international trade dynamics means that negotiations often face significant hurdles. Nations may have conflicting interests, particularly when it comes to protecting their local industries, which can hinder the negotiation process. For Scott, the recommendation to streamline trade discussions reflects a desire for clarity and simplicity in what often becomes a convoluted international trade landscape. This can establish a more resilient economic foundation while safeguarding American jobs.

Rick Scott’s Vision for America’s Trade Future

Rick Scott has positioned himself as a leading voice advocating for a trade policy that prioritizes American workers and manufacturers. His vision is firmly rooted in a belief that U.S. tariffs can redress past imbalances in trade that have heavily favored foreign producers, particularly in relation to China. Scott’s focus on reinforcing domestic industries indicates a desire to reshape not just the policy landscape but also the broader conversation on what it means to compete effectively on the global stage.

This vision aligns with a resurgence in nationalism within trade policy, where decisions are increasingly seen through the lens of national interest. As trade tensions evolve, Scott’s proposals for tariffs signify a commitment to protecting American economic interests, even if it may lead to turbulent trade relations with other nations. Ultimately, the legacy of these efforts will depend on both domestic economic health and international reactions to the U.S. stance on tariffs.

Frequently Asked Questions

How do tariffs impact the U.S. economy and trade policy?

Tariffs, such as those implemented by the U.S. government, directly affect the economy by raising the costs of imported goods, which can lead to inflation. These trade policies aim to protect U.S. manufacturers by making foreign products more expensive, potentially benefiting domestic workers in the short term. However, economists caution that tariffs may lead to retaliatory measures from other countries, affecting U.S. exports and disrupting trade relationships.

What are the implications of Rick Scott’s tariffs on American workers?

Senator Rick Scott argues that tariffs will level the playing field for American workers by reducing barriers to selling U.S. products abroad. He believes that by imposing tariffs, the U.S. can pressure other nations, particularly China, to lower their own tariffs on American goods. However, critics suggest that while intended to protect jobs, such tariffs may ultimately lead to higher prices for consumers and strained trade relations.

How do U.S. tariffs on China affect global trade relations?

The high import tariffs imposed on China—up to 145 percent on specific products—significantly impact global trade relations. This strategy is part of the broader U.S. trade policy aimed at combating trade deficits and protecting American industries. However, China’s retaliatory tariffs on U.S. imports can escalate tensions and create a trade war, which disrupts economic stability for both nations and their trading partners.

What is the relationship between tariffs and inflation in the U.S. economy?

There is an ongoing debate regarding the relationship between tariffs and inflation in the U.S. economy. While tariffs can increase the cost of imported goods, leading to higher prices for consumers, the exact impact on overall inflation rates remains uncertain. Experts suggest that managing inflation effectively may depend more on achieving a balanced budget rather than solely on the effects of tariffs.

Why does Rick Scott believe the U.S. should have a tough stance on trade with China?

Rick Scott asserts that a tough stance on trade with China is critical for U.S. economic security. He views China as a significant competitor and believes that limiting trade with China is essential to avoid potential conflicts. His perspective emphasizes the need for a strong approach to ensure that American industries and workers are protected from unfair competition.

What are the economic consequences of unilateral tariffs imposed by the U.S.?

The unilateral imposition of tariffs by the U.S. can lead to immediate economic consequences, including higher costs for consumers and potential retaliatory tariffs from affected countries. These measures can create volatility in stock markets and may contribute to economic downturns, as seen during the recent implementation of tariffs that partially contributed to a contraction in the U.S. gross domestic product.

What might be the future of U.S. trade policy under current tariff strategies?

The future of U.S. trade policy may hinge on the effectiveness of current tariffs in reshaping international trade dynamics. If these tariffs successfully encourage nations like China to reduce their own tariffs and trade barriers, the U.S. could strengthen its position in global trade. However, ongoing tensions and retaliatory actions may also prompt a reevaluation of such strategies in favor of more diplomatic negotiations.

How do import tariffs affect consumer prices in the U.S.?

Import tariffs generally lead to higher consumer prices in the U.S. as businesses pass on the increased costs of imported goods to consumers. This can cause a ripple effect throughout the economy, affecting everything from everyday products to raw materials for manufacturing. Consumers may face limited choices and pay more for goods due to tariff-induced price increases.

| Key Point | Details |

|---|---|

| Sen. Rick Scott’s Support for Tariffs | Scott believes tariffs will help the American worker by leveling the playing field against foreign competitors. |

| Impact of Tariffs on Trade Policy | The U.S. government imposed tariffs to reshape trade policy and reduce trade deficits. |

| Criticism of Tariff Strategy | Critics like Jason Furman argue that tariffs harm the U.S. economy and could deepen financial volatility. |

| Trade Relations with China | Scott advocates for no trade with China, citing their economic and political threat. |

| Tariffs and Inflation Concerns | Scott expresses uncertainty about tariffs’ impact on inflation, emphasizing the need for a balanced budget. |

| National Debt Perspective | Scott calls for reduced spending and a balanced budget to address the national debt, projected to reach $20 trillion. |

Summary

Tariffs and the U.S. economy are pivotal in shaping domestic and international trade dynamics. Senator Rick Scott champions the use of tariffs as a mechanism to protect American workers and strengthen U.S. manufacturing against foreign competition, especially from China. However, this approach has drawn skepticism from economists who fear that such tariffs could exacerbate economic volatility and lead to inflationary pressures, undermining the very goals they aim to achieve. The ongoing debates surrounding tariffs reflect a broader discussion about economic strategy, competitiveness, and the future of trade relations.