The U.S. economy recession has become a topic of increasing concern as various indicators point towards an impending downturn. With the ongoing trade war impacting consumer prices and trade dynamics, fears of diminished economic growth loom large over investors. This sentiment is only exacerbated by volatile stock market crashes and declining consumer confidence, as highlighted by the recent consumer sentiment index readings. Moreover, analysts and economists are closely watching the Federal Reserve’s decisions regarding interest rates, as these choices could either support recovery efforts or further amplify economic uncertainty. As the nation grapples with these challenges, understanding the interplay of these factors is crucial for anticipating future economic trends.

The looming recession in the United States has stirred widespread anxiety among economists, investors, and the general public alike. Factors such as international trade tensions, particularly the fallout from the trade war, combined with fluctuating market conditions, paint a grim picture of economic stability. Observations regarding consumer confidence levels reveal widespread trepidation, which could further impede economic activity. The difficulties faced by various sectors, coupled with the potential for corrective measures by financial authorities, add layers of complexity to the current economic landscape. As discussions about fiscal policy and interest rates intensify, it’s important to grasp the implications these developments hold for the broader economy.

The Impact of the Trade War on the U.S. Economy

The ongoing trade war has created significant economic ripples across the United States, particularly following the imposition of tariffs by neighboring countries in response to U.S. policies. This escalation has generated considerable uncertainty in the market, causing consumer sentiment to drop to unprecedented levels, as evidenced by the latest readings from the University of Michigan’s consumer sentiment index. The fear of prolonged economic strife exacerbated by these tariffs has left many consumers and investors hesitant, which may lead to a slowdown in economic activity. Businesses are particularly affected, as they struggle to navigate costs that rise due to tariffs, leading to potential layoffs and decreased hiring.

Moreover, the trade war has instigated a reaction from investors, resulting in heavy sell-offs in stock markets, which only adds to the climate of economic uncertainty. Many fear that, should this trend continue, it could herald a recession that the country may not be prepared to handle. The tension created by international trade disputes not only erodes consumer confidence but also influences the Federal Reserve’s decisions on interest rates. As the Fed wrestles with the challenges of stimulating growth without fostering inflation, the interplay of tariffs and economic uncertainty will be crucial in defining the U.S. economy’s immediate future.

Frequently Asked Questions

What is the impact of the trade war on the U.S. economy recession risk?

The ongoing trade war significantly raises recession risks for the U.S. economy. Elevated tariffs lead to increased costs for businesses, which may reduce investment and consumer spending. As the trade conflict escalates, it can create greater economic uncertainty, affecting confidence in markets and ultimately pushing the U.S. economy toward a recession.

How do Federal Reserve interest rates influence U.S. economy recession predictions?

Federal Reserve interest rates play a crucial role in shaping U.S. economy recession predictions. By adjusting rates, the Fed can either stimulate economic growth or contain inflation. In times of economic uncertainty, lowering interest rates can encourage borrowing and spending, potentially averting a recession. Conversely, maintaining higher rates amidst a recessionary context can exacerbate economic slowdowns.

What is the significance of the consumer sentiment index in relation to the U.S. economy recession?

The University of Michigan’s consumer sentiment index is a vital indicator of economic health and can signal potential U.S. economy recession. A decline in this index often reflects worsening consumer confidence, which may lead to decreased spending. If consumers anticipate economic challenges, their reduced expenditures can contribute to a slowdown and heighten recession fears.

How does economic uncertainty correlate with the likelihood of a U.S. economy recession?

Economic uncertainty is closely correlated with the likelihood of a U.S. economy recession. When factors like trade wars and financial instability increase unpredictability, consumers and investors tend to delay spending and investment decisions. This cautious behavior can directly impact economic growth, leading to reduced GDP and heightening the risk of recession.

What historical examples illustrate the impact of a stock market crash on the U.S. economy recession?

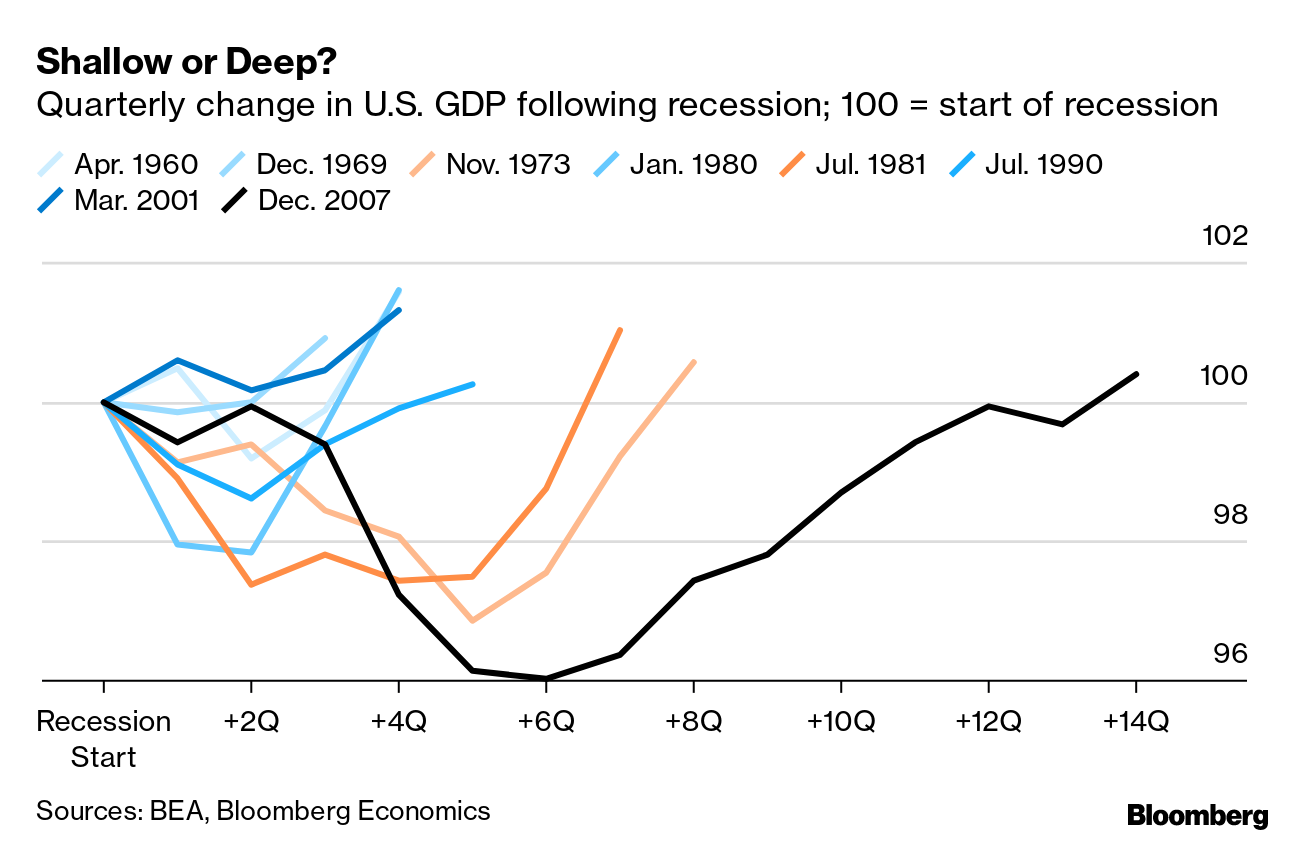

Historical examples, such as the 2008 financial crisis, illustrate the profound impact a stock market crash can have on the U.S. economy recession. A significant decline in stock prices can erode household wealth and consumer confidence, resulting in decreased spending. Such economic contractions can trigger recessions, as seen in past market turmoil, highlighting the fragile relationship between stock performance and overall economic health.

What measures can the Federal Reserve take to mitigate the risk of a U.S. economy recession?

To mitigate the risk of a U.S. economy recession, the Federal Reserve can lower interest rates to encourage borrowing and spending. Additionally, implementing quantitative easing measures can inject liquidity into the economy. By fostering a more favorable financial environment, the Fed aims to bolster economic activity and counteract potential recessionary trends.

How does government spending affect the potential for a U.S. economy recession?

Government spending plays a crucial role in shaping the potential for a U.S. economy recession. Increased spending can stimulate economic growth, especially during downturns, while austerity measures or significant cuts may lead to reduced economic activity and job losses. Hence, policy decisions regarding government expenditure are vital for managing recession risks in the U.S. economy.

In what ways does consumer confidence impact the U.S. economy during a recession?

Consumer confidence significantly impacts the U.S. economy during a recession. High consumer sentiment often leads to increased spending and investment, which can help stabilize the economy. Conversely, during a recession, if consumer confidence plummets, spending typically declines as consumers prioritize savings, potentially deepening the recession as demand wanes.

What are the implications of increasing perceptions of risk on the U.S. economy?

Increasing perceptions of risk can have dire implications for the U.S. economy, contributing to economic slowdown or recession. When businesses and consumers feel uncertain about future financial conditions, they tend to defer spending and investment decisions. This behavior can stifle economic growth, leading to higher unemployment rates and decreased consumer spending, further exacerbating recessionary pressures.

| Key Point | Details |

|---|---|

| Impact of Tariffs | Tariffs have led to heavy market losses and heightened fears of a recession. |

| Consumer Sentiment | The University of Michigan’s consumer sentiment index is at its lowest since November 2022. |

| Economic Outlook | Economists are increasingly worried about the risk of a recession within the next year due to various economic pressures. |

| Factors Leading to Recession | Trade war, stock market crash, cuts in government spending, fiscal crisis, and increased risk perception are significant worries. |

| Federal Reserve’s Dilemma | The Fed faces a challenge in balancing rate cuts to support the economy while controlling inflation. |

Summary

The current situation concerning the U.S. economy recession is alarming, with rising fears of an economic downturn due to various external and internal factors, including trade conflicts and declining consumer confidence. As analysts observe potential recession indicators, it becomes crucial to monitor these developments closely, as they could significantly impact economic stability in the upcoming months.